Should You Avoid Active Investing?

If you've ever thought about trying to beat the stock market, you're not alone. The allure of picking winning stocks or funds to outperform the market is strong. After all, who doesn’t want to outsmart Wall Street?

Continue reading

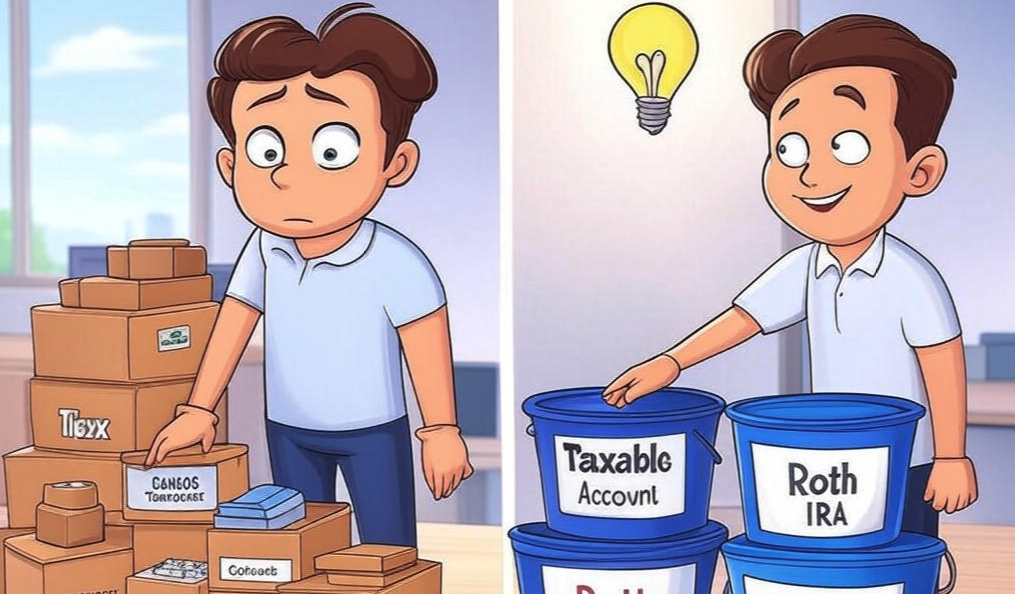

Why Asset Location Matters Just as Much as Asset Allocation

Most investors understand the importance of asset allocation - how you divide your portfolio between stocks, bonds, and other assets. But far fewer consider asset location - which accounts hold which investments.

Continue reading

The 4% Rule: Does It Still Work for Retirement Withdrawals?

One of the most widely cited retirement guidelines is the 4% rule—the idea that retirees can safely withdraw 4% of their portfolio in the first year of retirement, adjust for inflation annually, and have a high probability of not outliving their savings over 30 years. But with rising lifespans, volatile markets, and low bond yields, many wonder: Is the 4% rule still valid today?

Continue reading

How Low-Cost ETFs Can Improve Your Investment Returns

Investing isn’t just about picking the right assets—it’s also about keeping more of your returns. One of the easiest ways to do this? Low-cost ETFs (Exchange-Traded Funds). While fees might seem small at first glance, they compound over time just like your investments. Choosing funds with lower expenses can mean tens or even hundreds of thousands of dollars more in retirement—without requiring you to take on additional risk.

Continue reading

Stocks vs. Bonds: Understanding Risk and Return

Every investor faces a fundamental question: How should I balance risk and reward in my portfolio? The answer often comes down to two core asset classes—stocks and bonds. While both play critical roles in wealth-building, they behave very differently. Stocks offer growth potential but come with volatility. Bonds provide stability but usually deliver lower returns. Understanding these differences is key to building a portfolio that aligns with your goals, timeline, and risk tolerance.

Continue reading

Why Long-Term Investing Beats Trying to Time the Market

One of the most common mistakes investors make is believing they can outsmart the market by buying low and selling high at just the right moments. While market timing might seem like a lucrative strategy, decades of research—and the experiences of millions of investors—prove that long-term investing consistently outperforms short-term speculation.

Continue reading

An Investing Primer

Investing is as much about psychology as it is about numbers. The markets are unpredictable, and emotions often drive decisions more than logic.

Continue reading

Importance of Low Cost Index Funds

Decades of research, real-world data, and the sobering lessons of market history point to a clear conclusion: Low-cost index funds are the most reliable, efficient, and effective way for most individuals to grow their wealth

Continue reading

Approaching Retirement

As you approach retirement, one of the first major financial considerations is ensuring that you have enough savings to maintain your lifestyle throughout retirement.

Continue reading

Selecting a Wealth Manager

Selecting the right wealth manager is one of the most important decisions you’ll make for your financial future.

Continue reading

Justifying Bonds

Bonds play a critical role in a well-rounded investment portfolio, primarily by providing stability and income.

Continue reading

Asset Class Selection

Selecting the right asset classes is a key component of building a diversified investment portfolio.

Continue reading

Get The Plain Wealth newsletter right to your inbox for free!

Thank you for subscribing!

Have a great day!